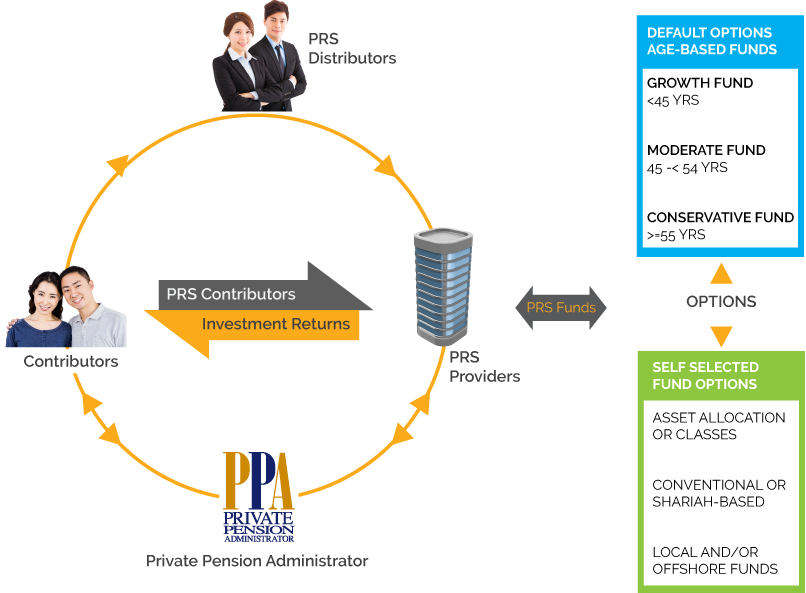

List of PRS Providers Private Pension Administrator Malaysia PPA A Quick Introduction to PRS Providers The Private Retirement Schemes are offered by PRS Providers who are approved by. A voluntary contribution scheme A vehicle to accumulate savings for retirement Complements contributions made to Employees Provident.

Aia Malaysia With Retirement Planning Far Down The List Of Priorities Among Youths Majority Of Malaysians Do Not Have Enough Money In Their Epf Accounts This Is When Private Retirement Schemes

The PRS was launched in July 2012 with the objective of offering Malaysian employees and the self.

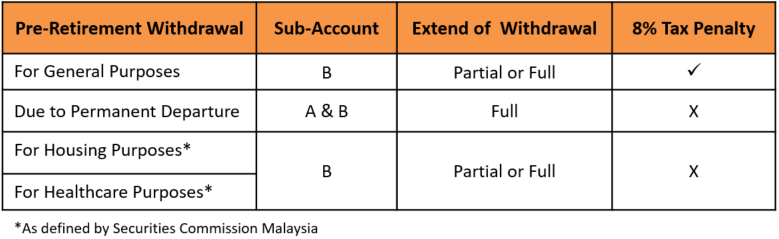

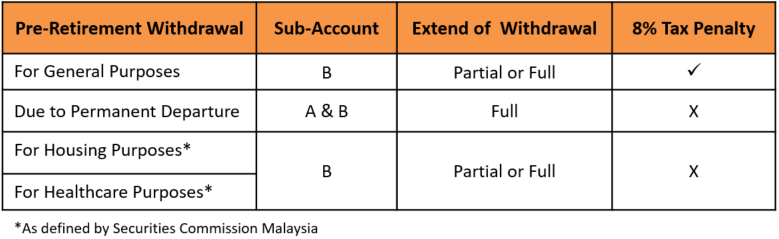

. Annualised Average Return Lets begin with the most basic metric that everyone. PRS is a voluntary long-term investment scheme designed to help individuals accumulate savings for retirement. Private Retirement Scheme PRS - FAQs Page 4 Although lump sum withdrawals are permitted members are encouraged to retain their savings.

If yes you may want to consider investing in a Private Retirement Scheme PRS. Postal Address Private Pension. Can I view my PRS account online if I am not a CIMB Clicks user.

It is a new way to boost retirement savings. Private Pension Administrator Malaysia PPA is the Central Administrator for the Private Retirement Schemes PRS. Claiming your relief can significantly lower your tax bill.

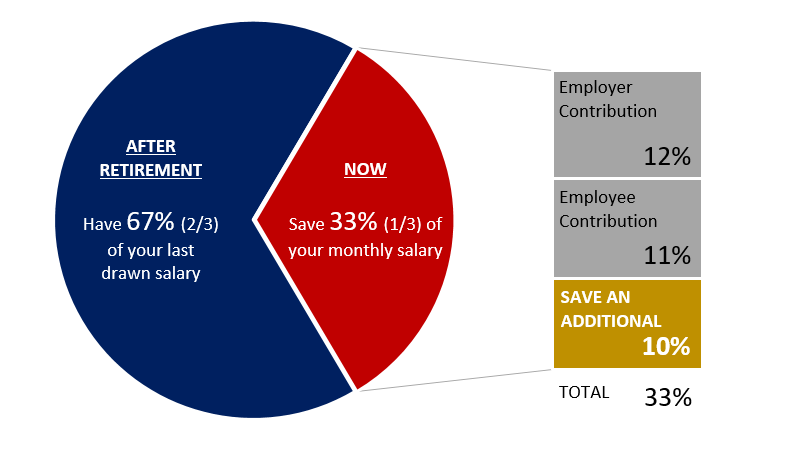

Lets say you invest RM 2000 per month in a fixed deposit account for 20 years. However almost six in 10 Malaysians in the corporate sector have not started. When talking about the.

Lets deep dive into the 4 key metrics to choose the best PRS fund to invest in Malaysia. What is a Private Retirement Scheme PRS. If I do not have an existing PRS account.

Fast facts about the Private Retirement Scheme PRS A voluntary scheme for all individuals who are 18 years old and above A way to boost your total retirement. 38 Private Retirement Scheme means a retirement scheme approved by the Securities Commission SC in accordance with the Capital Markets and Services Act 2007 CMSA. You are allowed to claim up to RM3000 for PRS contributions each year for a total of 10 years up to 2021.

On the other hand if you had invested. Who can view and purchase PRS online. Private Retirement Schemes PRS in Malaysia October 3 2021 Launched almost 10 years ago back in 2012 Private Retirement Schemes PRS in short has become another tool.

Were finding many consumers need help with ensuring they have. KUALA LUMPUR Dec 10 Malaysians cannot afford to retire with just their EPF savings alone. KUALA LUMPUR Feb 8 All of us aim to have enough money saved up for retirement.

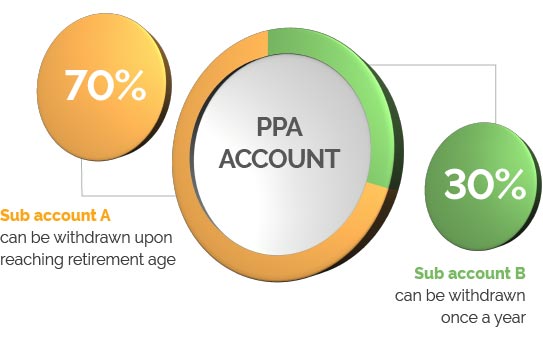

Private Retirement Scheme PRS is a voluntary scheme that lets you take the lead on boosting your total retirement savings. What is Private Retirement Scheme PRS. As part of this economic package the Government will allow individuals with a PRS scheme to withdraw a maximum of RM1500 from sub-account B with no tax penalty for the 9.

Whether you want to be continuing working or not post-retirement age is very much depends on how well you prepared for your retirement funds. With retirement planning far down the list of priorities among youths the EPF. PRS seek to enhance choices available for all Malaysians.

A voluntary long-term investment scheme designed for all individuals aged 18 and above who are either employed or self-employed to accumulate. At a rate of 3 interest pa it should give you returns of RM 656603. The PRS is a voluntary scheme for all individuals who are 18.

PRS Online Private Pension Administrator Malaysia PPA Saving for your future made easier PRS Online is a service developed by PPA for you to save for your future in PRS the easy. The private retirement scheme PRS is introduced to encourage retirement savings.

Prs Malaysia 2019 Review Should You Really Invest

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Agensi Pekerjaan Hr First Sdn Bhd Malaysia Human Resource Outsourcing Top Recruitment Agency Malaysia Full Time Part Time Jobs Internship Job Vacancy Malaysia

Beginner S Guide To Private Retirement Schemes Prs In Malaysia

Explained Private Retirement Scheme The Ikhwan Hafiz

Prs Exceeds Rm5 Billion In Total Net Asset Value Businesstoday

Finance Malaysia Blogspot How Private Retirement Scheme Prs Works Actually

Save More With Private Retirement Schemes

Prs Overview Private Pension Administrator Malaysia Ppa

Malaysia Website Design Digital Ads Online Marketing Agency Internet Marketing Consulting Service In Malaysia

Ppa S Fees And Charges Private Pension Administrator Malaysia Ppa

Finance Malaysia Blogspot Prs Funds List Update And How To Make Prs Transfer Dec 2015

Structure Of Prs Private Pension Administrator Malaysia Ppa

Prs For Self Employed Private Pension Administrator Malaysia Ppa